Preliminary Proxy Statement | ||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

Definitive Proxy Statement | ||

Definitive Additional Materials | ||

Soliciting Material under §240.14a-12 | ||

| PACIFIC PREMIER BANCORP, INC. | |||

(Name of Registrant as Specified | |||

Not Applicable | |||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| Payment of Filing Fee (Check the appropriate box): | |||||

No fee required. | |||||

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||

| 1. | Title of each class of securities to which transaction applies: | ||||

| 2. | Aggregate number of securities to which transaction applies: | ||||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||

| 4. | The filing fee was determined based on | ||||

| Proposed maximum aggregate value of transaction: | |||||

| 5. | Total fee paid: | ||||

| [ ] | Fee paid previously with preliminary materials. | ||||

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

1. | Amount Previously Paid: | ||||

| 2. | Form, Schedule or Registration Statement No.: | ||||

| 3. | Filing Party: | ||||

| 4. | Date Filed: | ||||

9, 2019 Meeting even if you cannot attend. ITEM 2. TO APPROVE, ON A NON-BINDING ADVISORY BASIS, THE COMPENSATION OF THE

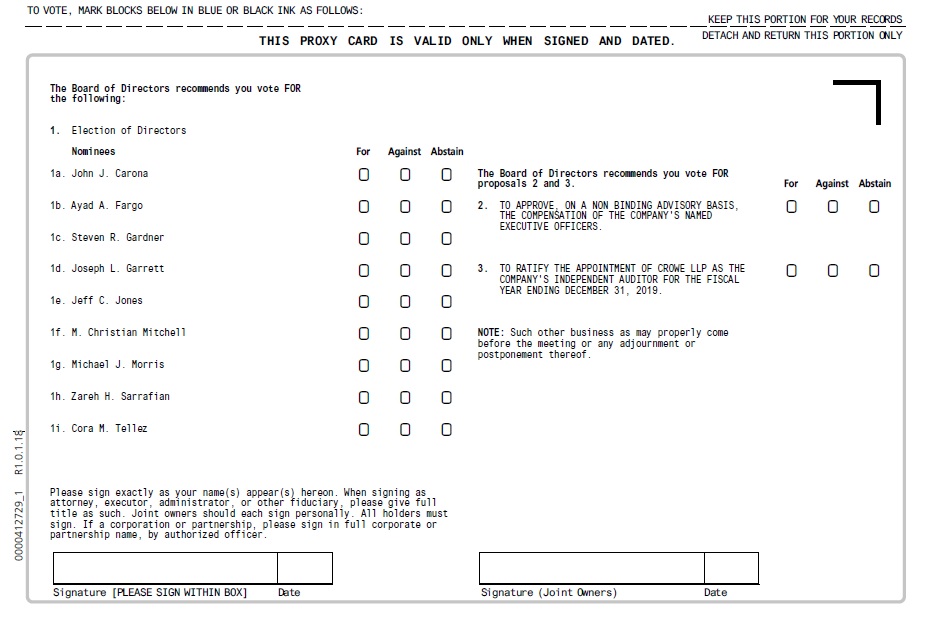

27, 2017"Company"“Company”), you are cordially invited to attend the 2019 Annual Meeting of Stockholders of the Company ("(“Annual Meeting"Meeting”). The Annual Meeting will be held on Wednesday,Monday, May 31, 2017,20, 2019, at 9:00 a.m., Pacific Time, at the Company'sCompany’s corporate headquarters located at 17901 Von Karman Avenue, Suite 1200, Irvine, California 92614.Company'sCompany’s Board of Directors has determined that each of the proposals that will be presented to the stockholders for their consideration at the Annual Meeting are in the best interests of the Company and its stockholders, and unanimously recommends and urges you to vote "FOR"“FOR” each director nominee, "FOR" an annual“FOR” the approval, on a non-binding advisory vote on executive compensation, and "FOR" approvalbasis, of the proposed amendment tocompensation of the Pacific Premier Bancorp, Inc. AmendedCompany’s named executive officers, and Restated 2012 Long-Term Incentive Plan,“FOR” ratification of Crowe LLP as the Company’s independent auditor for the reasons set forth therein.fiscal year ending December 31, 2019. If any other business is properly presented at the Annual Meeting, the proxies will be voted in accordance with the recommendations of the Company'sCompany’s Board of DirectorsDirectors.it is important thatwe encourage you to vote via the Internet, by telephone or sign date and return the enclosedyour proxy card inprior to the enclosed postage-paid envelope. Your cooperation is appreciated since a majoritymeeting, so that your shares of the common stock mustwill be represented either in person or by proxy, to constitute a quorum for the transaction of businessand voted at the Annual Meeting.

PACIFIC PREMIER BANCORP, INC.17901 Von Karman Avenue, Suite 1200Irvine, California 92614949-864-8000NOTICE OF ANNUAL MEETING OF STOCKHOLDERSTo Be Held May 31, 2017NOTICE IS HEREBY GIVEN thatStockholders ("2018 Annual Meeting") of Pacific Premier Bancorp, Inc. (the "Company") will be heldReport, and our Annual Report on Wednesday, May 31, 2017 at 9:00 a.m., Pacific Time, at the Company's corporate headquarters located at 17901 Von Karman Avenue, Suite 1200, Irvine, California, to consider and act upon the following matters:1.To elect ten (10) directors, each for a one-year term, or until their successors are elected and qualified;2.To approve, on a non-binding advisory basis, the Company's executive compensation;3.To approve the amendment to the Pacific Premier Bancorp, Inc. Amended and Restated 2012 Long-Term Incentive Plan to increase the number of shares available for grant under such plan;4.To ratify the appointment of Crowe Horwath LLP as the Company's independent auditorForm 10-K for the fiscal year endingended December 31, 2017; and5.To transact such other matters as may properly come before the meeting and at any adjournments thereof. Management is not aware of any other such business.The Board of Directors has fixed April 12, 2017 as the record date for determination of stockholders entitled to receive notice of and to vote at the Annual Meeting and any adjournment thereof. Only those stockholders of record as of the close of business2018, are available on that date will be entitled to vote at the Annual Meeting or at any such adjournment.By Order of the Board of Directors,![]()

Robert A. TiddCorporate SecretaryIrvine, CaliforniaApril 27, 2017IMPORTANT:Whether or not you expect to attend the Annual Meeting, we urge you to vote your proxy at your earliest convenience via the Internet by telephone or mail by usingat www.proxyvote.com and from our corporate website at www.ppbi.com under the enclosed postage-paid reply envelope. This will ensure the presence of a quorum at the Annual Meeting and will save the Company the expense of additional solicitation. Submitting your proxy will not prevent you from voting your shares in person at the Annual Meeting if you desire to do so. Your proxy is revocable at your option in the manner described in the Proxy Statement.IMPORTANT NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS FOR THEANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 31, 2017“Investors”The proxy materials for section. Information on this Annual Meeting, which consist ofwebsite, other than the Proxy Statement, annual report, and formis not a part of proxy, are available over the Internet atenclosed Proxy Statement.www.voteproxy.com.ContentsTablethe Stockholders (“Annual Meeting”) of Contents1. To elect nine (9) directors, each for a one-year term, or until their successors are elected and qualified; 2. To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers; 3. To ratify the appointment of Crowe LLP as the Company’s independent auditor for the fiscal year ending December 31, 2019; 4. To transact such other matters as may properly come before the meeting and at any postponement or adjournment thereof. Management is not aware of any other such business. By Order of the Board of Directors,

Steve Arnold Senior Executive Vice President, General Counsel and Corporate Secretary Irvine, California April 9, 2019 INFORMATION ABOUT THE ANNUAL MEETING 5 Board Nominees 5Nominated Directors Corporate Governance 9Committees of the Board of Directors (2016) Committees of the Board of Directors (Effective April 13, 2017) 14 Compensation Committee Report 46 Summary Compensation Table 4748Outstanding Equity Awards49Exercised Options and Restricted Stock Vested in 201650Pension Benefits50Nonqualified Deferred Compensation51Potential Payments Upon Termination or a Change in Control51Compensation of Non-Employee Directors53Deferred Compensation Plan55RELATED TRANSACTIONS AND OTHER MATTERS59Transactions with Certain Related Persons59Indebtedness of Management60SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE60COMPANY'SCOMPANY’S NAMED EXECUTIVE OFFICERS ITEM 3. TO APPROVE THE AMENDMENT TO THE COMPANY'S 2012 LONG-TERM INCENTIVE PLAN 61iITEM 4. TO RATIFY THE APPOINTMENT OF CROWE HORWATH LLP AS THE COMPANY'S INDEPENDENT AUDITOR FOR THE FISCAL YEAR ENDING DECEMBER 31, 201767Fees69Audit Committee Pre-Approval Policies and Procedures70REPORT OF THE AUDIT COMMITTEE70ANNUAL REPORT71HOUSEHOLDING71STOCKHOLDER PROPOSALS FOR THE 2018 ANNUAL MEETING71OTHER MATTERS72Appendix A — Amendment to Pacific Premier Bancorp, Inc. Amended and Restated 2012 Long-Term Incentive PlanA-1iiPACIFIC PREMIER BANCORP, INC.17901 Von Karman Avenue, Suite 1200Irvine, California 92614

GENERAL INFORMATIONFor the 2017 Annual Meeting of StockholdersTo Be Held on Wednesday, May 31, 2017

Our Board of Directors is soliciting proxies to be voted at our 2017 Annual Meeting of Stockholders ("Annual Meeting") on May 31, 2017, at 9:00 a.m., Pacific Time, for the purposes set forth in the attached Notice of Annual Meeting of Stockholders (the "Notice") and in this Proxy Statement. This Proxy Statement and the proxies solicited hereby are being first sent or delivered to stockholders of the Company on or about April 27, 2017.

As used in this Proxy Statement, the terms "Company," "we," "us" and "our" refer to Pacific Premier Bancorp, Inc., the term "Bank" refers to Pacific Premier Bank and the terms "Board of Directors" and "Board" refers to the Board of Directors of the Company.

|

Question: Why am I receiving these materials?

Answer: Our Board of Directors is providing these proxy materials to you in connection with the Annual Meeting, to be held on May 31, 2017. As a stockholder of record as of April 12, 2017 (the "Record Date"), you are invited to attend the Annual Meeting, and are entitled to and requested to vote on the items of business described in this Proxy Statement.

Question: What information is contained in this Proxy Statement?

Answer: This information relates to the proposals to be voted on at the Annual Meeting, the voting process, compensation of our directors and most highly paid executives, and certain other required information.

Question: Can I access the Company's proxy materials and annual report electronically?

Answer: Yes. The Proxy Statement, form of proxy and annual report are available atwww.voteproxy.com. To view this material, you must have available the 12-digit control number

located on the proxy card or, if shares are held in the name of a broker, bank or other nominee, the voting instruction form.

Question: Who is soliciting my vote pursuant to this Proxy Statement?

Answer: Our Board of Directors is soliciting your vote at the Annual Meeting.

Question: Who is entitled to vote?

Answer: Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting.

Question: How many shares are eligible to be voted?

Answer: As of the Record Date, we had 39,814,732 shares of common stock outstanding. Each outstanding share of our common stock will entitle its holder to one vote on each of the ten (10) director nominees to be elected and one vote on each other matter to be voted on at the Annual Meeting.

Question: What am I voting on?

Answer: You are voting on the following matters:

•The election of ten (10) director nominees. Our director nominees are John J. Carona, Ayad A. Fargo, Steven R. Gardner, Joseph L. Garrett, Jeff C. Jones, Simone F. Lagomarsino, Michael J. Morris, Michael E. Pfau, Zareh H. Sarrafian, and Cora M. Tellez;•The approval, on a non-binding advisory basis, of the Company's executive compensation;•The approval of the amendment to the Pacific Premier Bancorp, Inc. Amended and Restated 2012 Long-Term Incentive Plan (the "2012 Long-Term Incentive Plan"); and•The ratification of the appointment of Crowe Horwath LLP as the Company's independent auditor for the fiscal year ending December 31, 2017.

Question: How does our Board of Directors recommend that I vote?

Answer: Our Board recommends that stockholders vote their shares as follows:

•"FOR"each director nominee;•"FOR"the approval, on a non-binding advisory basis, of the Company's executive compensation;•"FOR"the approval of the amendment to the 2012 Long-Term Incentive Plan; and•"FOR"the ratification of the appointment of Crowe Horwath LLP as the Company's independent auditor for the fiscal year ending December 31, 2017.

Question: How many votes are required to hold the Annual Meeting and what are the voting procedures?

Answer:Quorum Requirement: As of the Record Date, 39,814,732 shares of the Company's common stock were issued and outstanding. A majority of the outstanding

shares entitled to vote at the Annual Meeting, present or represented by proxy, constitutes a quorum for the purpose of adopting proposals at the Annual Meeting. If you submit a properly executed proxy, then you will be considered part of the quorum.

Required Votes: Each outstanding share of our common stock is entitled to one vote on each proposal at the Annual Meeting.

If there is a quorum at the Annual Meeting, the matters to be voted upon by the stockholders require the following votes for such matter to be approved:

•Election of Directors.Because the election of directors to occur at the Annual Meeting is not contested, the vote required for the election of each of the ten (10) director nominees by the stockholders is the affirmative vote of a majority of the votes cast in favor of or against the election of such director nominee. There is no cumulative voting for our directors. If you indicate "withhold authority to vote" for a particular nominee on your proxy card, your vote will not count either "FOR" or "AGAINST" the nominee. Abstentions are not counted in the election of directors and do not affect the outcome.•Advisory Vote on Approval of Executive Compensation.The affirmative vote of holders of at least of a majority of the shares for which votes are cast at the Annual Meeting is required to approve, on a non-binding advisory basis, the Company's executive compensation. Abstentions will not be counted as votes cast and, therefore, will not affect the outcome.•Amendment to 2012 Long-Term Incentive Plan.The affirmative vote of holders of at least the majority of the shares for which votes are cast at the Annual Meeting is required for Approval of the amendment to the 2012 Long-Term Incentive Plan. Abstentions will not be counted as votes cast and, therefore, will not affect the outcome.

•Ratification of Independent Auditors.The affirmative vote of holders of at least the majority of the shares for which votes are cast at the Annual Meeting is required for ratification of the appointment of Crowe Horwath LLP as our independent auditor for the fiscal year ending December 31, 2017. Abstentions will not be counted as votes cast and, therefore, will not affect the outcome.

If a broker indicates on its proxy that it submits to the Company that it does not have authority to vote certain shares held in "street name," the shares not voted are referred to as "broker non-votes." Broker non-votes occur when brokers do not have discretionary voting authority to vote certain shares held in "street name" on particular proposals under the rules of the New York Stock Exchange, and the "beneficial owner" of those shares has not instructed the broker how to vote on those proposals. If you are a beneficial owner and you do not provide instructions to your broker, bank or other nominee, your broker, bank or other nominee is permitted to vote your shares for or against "routine" matters such as Item 4 the ratification of the appointment of our independent registered public accounting firm. Brokers are not permitted to exercise discretionary voting authority to vote your shares for or against "non-routine" matters. All of the matters on which stockholders will be asked to vote on at the Annual Meeting, with the exception of Item 4, Ratification of Independent Auditors, are "non-routine" matters.

Shares represented by proxies that are marked vote "withheld" with respect to the election of any nominee for director will not be considered in determining whether such nominee has received the affirmative vote of a plurality of the shares.

Question: How may I cast my vote?

Answer: If you are the stockholder of record, you may vote by one of the following four methods (as instructed on the enclosed proxy card):

•in person at the Annual Meeting;•via the Internet;•by telephone; or•by mail.

If you would like to vote in person at the Annual Meeting and would like to obtain directions to the Annual Meeting please contact Investor Relations, Pacific Premier Bancorp, Inc., 17901 Von Karman Avenue, Suite 1200, Irvine, California 92614 at (949) 864-8000.

If you elect to vote by mail and you received a printed proxy card, you may mark, sign, date and mail the proxy card you received from us in the return envelope. If you did not receive a printed proxy card and wish to vote by mail, you may do so by requesting a paper copy of the proxy materials (as described below), which will include a proxy card.

Whichever method of voting you use, the proxies identified on the proxy card will vote the shares of which you are the stockholder of record in accordance with your instructions. If you submit a proxy card properly voted and returned through available channels without giving specific voting instructions, the proxies will vote the shares as recommended by our Board of Directors.

If you own your shares in "street name," that is, through a brokerage account or in another nominee form, you must provide instructions to the broker or nominee as to how your shares should be voted. Your broker or nominee will usually provide you with the appropriate instruction forms at the time you receive this Proxy Statement and our annual report. If you own your shares in this manner, you cannot vote in person at the Annual Meeting unless you receive a proxy to do so from the broker or the nominee, and you bring the proxy to our Annual Meeting.

Question: How may I cast my vote over the Internet or by telephone?

Answer:Voting over the Internet: If you are a stockholder of record, you may use the Internet to transmit your vote up until 11:59 p.m., Eastern Time, May 30, 2017. Visitwww.voteproxy.com and have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form.

Voting by Telephone: If you are a stockholder of record, you may call 1-800-776-9437 and use any touch-tone telephone to transmit your vote up until 11:59 p.m., Eastern Time, May 30, 2017. Have your proxy card in hand when you call and then follow the instructions.

If you hold your shares in "street name," that is through a broker, bank or other nominee, that institution will instruct you as to how your shares may be voted by proxy, including whether telephone or Internet voting options are available.

Question: How may a stockholder nominate someone at the Annual Meeting to be a director or bring any other business before the Annual Meeting?

Answer: The Company's Amended and Restated Bylaws (the "Bylaws") require advance notice to the Company if a stockholder intends to attend an annual meeting of stockholders in person and to nominate someone for election as a director or to bring other business before the meeting. Such a notice may be made only by a stockholder of record within the time period established in the Bylaws and described in each year's Proxy Statement. See "Stockholder Proposals for the 2018 Annual Meeting" beginning on page 71.

Question: How may I revoke or change my vote?

Answer: If you are the record owner of your shares, and you completed and submitted the proxy card, you may revoke your proxy at any time before it is voted at the Annual Meeting by:

•submitting a new proxy card with a later date,•delivering written notice to our Secretary on or before May 30, 2017, stating that you are revoking your proxy,•attending the Annual Meeting and voting your shares in person, or•If you are a record owner of your shares and you submitted your proxy by telephone or via the Internet, you may change your vote or revoke your proxy with a later telephone or Internet proxy, as the case may be.

Please note that attendance at the Annual Meeting will not, in itself, constitute revocation of your proxy.

If you own your shares in "street name," you may later revoke your voting instructions by informing the bank, broker or other holder of

record in accordance with that entity's procedures.

Question: Who is paying for the costs of this proxy solicitation?

Answer: The Company will bear the cost of preparing, printing and mailing the materials in connection with this solicitation of proxies. In addition to mailing these materials, officers and regular employees of the Company may, without being additionally compensated, solicit proxies personally and by mail, telephone, facsimile or electronic communication. We have retained DF King & Co., Inc. to assist in the solicitation at a cost of approximately $8,500.00, plus payment of reasonable out-of-pocket expenses incurred by DF King & Co., Inc.

Question: Who will count the votes?

Answer: American Stock Transfer & Trust Company, LLC ("AST") will receive and tabulate the ballots and voting instruction forms.

Question: How can I obtain the Company's Corporate Governance information?

Answer: Our Corporate Governance information is available on our website atwww.ppbi.com under the Investor Relations section. Our stockholders may also obtain written copies at no cost by writing to us at 17901 Von Karman Avenue, Suite 1200, Irvine, California 92614, Attention: Investor Relations Department, or by calling (949) 864-8000.

Question: How do I request electronic or printed copies of this and future proxy materials?

Answer: You may request and consent to delivery of electronic or printed copies of future proxy statements, annual reports and other stockholder communications by

•visitingwww.voteproxy.com,•calling 1-800-579-1639, or•sending an email tosendmaterial@voteproxy.com.

When requesting copies of proxy materials and other stockholder communications, you should have available the 12-digit control number located on the proxy card or, if shares are held in the name of a broker, bank or other nominee, the voting instruction form.

INFORMATION ABOUT THE ANNUAL MEETING

Our Annual Meeting will be held at 9:00 a.m., Pacific Time, on Wednesday, May 31, 2017, at our corporate headquarters located at 17901 Von Karman Avenue, Suite 1200, Irvine, California 92614.

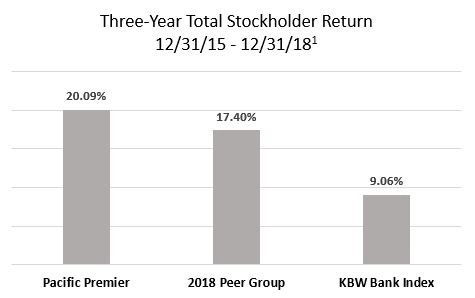

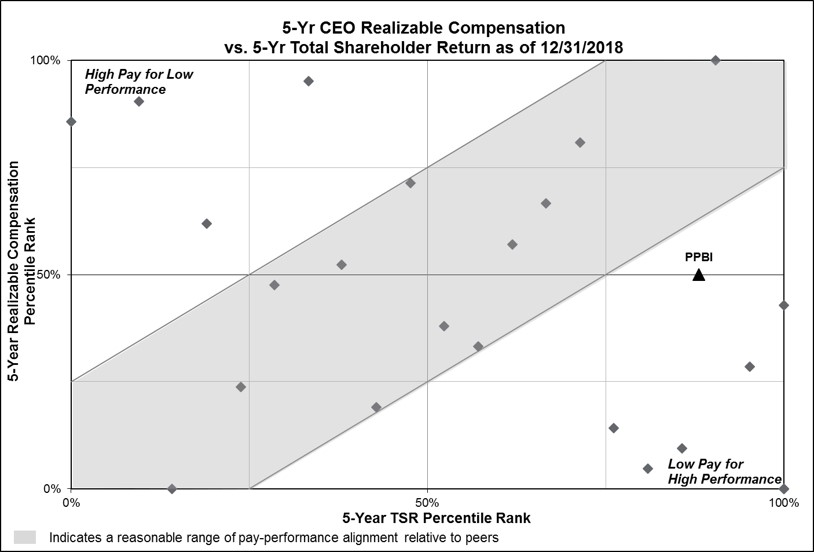

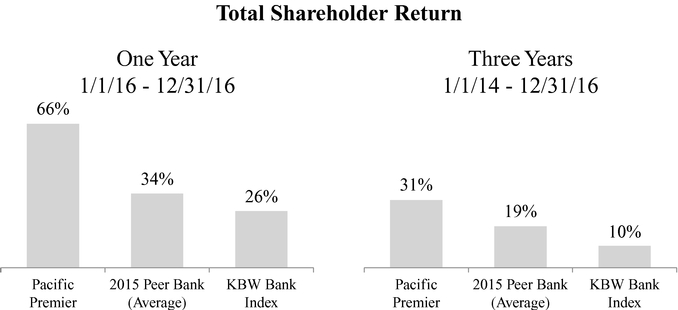

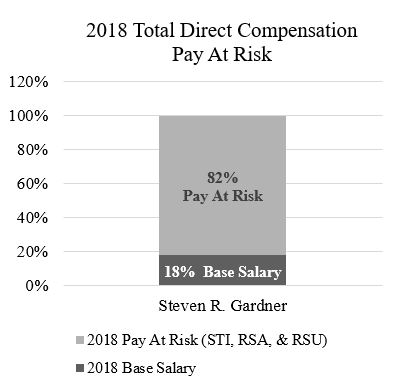

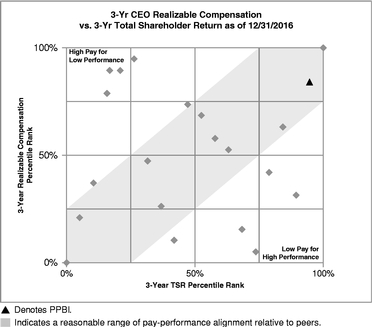

Board Nominees Nominated Directors Fullerton and attended graduate school at California State University, Long Beach. Mr. Garrett received his A.B. and M.B.A. from the University of California (Berkeley) and his M.A. from the University of Washington (Seattle). Corporate Governance Corporate Governance Policy. The vertical axis displays the primary Sarrafian, and Cora M. Tellez are independent under the NASDAQ In addition, each director is subject to the Company’s Related Party Transactions Policy, pursuant to which transactions between the Company or the Bank, on one hand, and any of our directors or certain of their affiliates, on the other hand, need to be approved or ratified by disinterested members of the Governance Committee, if not otherwise pre-approved under the terms of the policy. For more information, see “Related-Party Transactions” under “Transactions with Certain Related Persons.” Board at which the Chairman is not present, including executive sessions of the independent directors; and Board members to whom it is directed. Ethics and any waiver that applies to one of our senior financial officers or a member of our Board of Directors will be posted to our website. rules of the expert,” and is independent under the NASDAQ listing standards and rules of the SEC. committees; and assessment of current security updates, cyber statistics, core elements and controls, and key IT trends affecting information security. Ms. Tellez (2 reports). Equity compensation plans approved by security holders: (1) 2004 Long-term Incentive Plan 2012 Stock Long-Term Incentive Plan Equity compensation plans not approved by security holders Total Equity Compensation plans Each person has sole voting and investment power with respect to the shares they beneficially own. John J. Carona Ayad Fargo Joseph L. Garrett Jeff C. Jones Simone Lagomarsino Michael Morris Michael Pfau Zareh Sarrafian Cora Tellez Steven R. Gardner Edward Wilcox Ronald J. Nicolas, Jr. Michael S. Karr Thomas Rice Stock Ownership of all Directors and Executive Officers as a Group (14 persons) stock, which had a value amounting to approximately $60,000 as of the date of grant, based upon the closing price of the Company’s common stock as of such date. own shares of the , $19,544 of which costs were borne by the non-employee directors. Name Kenneth A. Boudreau * John J. Carona Joseph L. Garrett John D. Goddard * Jeff C. Jones Michael L. McKennon * Cora Tellez Ayad Fargo Zareh Sarrafian Kenneth A. Boudreau * John J. Carona Joseph L. Garrett John D. Goddard * Jeff C. Jones Michael L. McKennon * Cora Tellez Ayad Fargo Zareh Sarrafian Steven R. Gardner in the table below: Group on the basis of total assets. Those members of the 2017 peer group not appearing in the 2018 Peer Group were excluded for a variety of factors, including but not limited to having business models primarily focused on business lines other than commercial banking or having total asset size that was not within the standard of deviation the Company desired when compiling the 2018 Peer Group. The following companies comprised the Base Salary. Steven R. Gardner Edward Wilcox Thomas Rice Michael S. Karr Ronald J. Nicolas, Jr. E. Allen Nicholson their targeted cash incentive amount. The table below shows the Net income Loan growth Deposit growth Steven R. Gardner Edward Wilcox Michael S. Karr Thomas Rice Ronald J. Nicolas, Jr. E. Allen Nicholson The ” The following table provides information on the Steven R. Gardner Edward Wilcox Thomas Rice Michael S. Karr Ronald J. Nicolas, Jr. E. Allen Nicholson awards. The annual grants of long-term incentives are treated as an award earned by service in the prior year. Steven R. Gardner Edward Wilcox Thomas Rice Michael S. Karr Ronald J. Nicolas, Jr. (1) E. Allen Nicholson in accordance with FASB ASC Topic 715 as of December 31, 2018. Payments NEO’s express written consent. Steven R. Gardner Edward Wilcox Ronald J. Nicolas, Jr. E. Allen Nicholson Michael S. Karr Thomas Rice Name Steven R. Gardner Edward Wilcox Michael S. Karr Thomas Rice Ronald J. Nicolas, Jr. Steven R. Gardner Edward Wilcox Ronald J. Nicolas, Jr. Michael S. Karr Thomas Rice Steven R. Gardner Edward Wilcox Accelerated Vesting of Equity Restricted stock awards and unvested stock options granted prior to 2018 generally will vest in full in the event that the Kenneth A. Boudreau * John J. Carona Joseph L. Garrett John D. Goddard * Jeff C. Jones Michael L. McKennon * Cora Tellez Ayad Fargo Zareh Sarrafian Kenneth A. Boudreau * John J. Carona Joseph L. Garrett John D. Goddard * Jeff C. Jones Michael L. McKennon * Cora Tellez Ayad Fargo Zareh Sarrafian Summary of Potential Termination Payments Steven R. Gardner Termination for Cause or resignation without Disability or Good Reason (not within two years after a change in control) Death Disability Retirement Change in Control (regardless of termination) Termination by us without Cause, or by NEO for Good Reason (not within two years after change in control) Termination by us without Cause or by NEO for Good Reason within two years after a change in control (5)(6) Edward Wilcox Termination for Cause or resignation without Disability or Good Reason (not within two years after a change in control) Death Disability Retirement Change in Control (regardless of termination) Termination by us without Cause, or by NEO for Good Reason (not within two years after change in control) Termination by us without Cause or by NEO for Good Reason within two years after a change in control (5)(6) Ronald J. Nicolas, Jr. Termination for Cause or resignation without Disability or Good Reason (not within two years after a change in control) Death Disability Retirement Change in Control (regardless of termination) Termination by us without Cause, or by NEO for Good Reason (not within two years after change in control) Termination by us without Cause or by NEO for Good Reason within two years after a change in control (6) Michael S. Karr Termination for Cause or resignation without Disability or Good Reason (not within two years after a change in control) Death Disability Retirement Change in Control (regardless of termination) Termination by us without Cause, or by NEO for Good Reason (not within two years after change in control) Termination by us without Cause or by NEO for Good Reason within two years after a change in control (6) Thomas Rice Termination for Cause or resignation without Disability or Good Reason (not within two years after a change in control) Death Disability Retirement Change in Control (regardless of termination) Termination by us without Cause, or by NEO for Good Reason (not within two years after change in control) Termination by us without Cause or by NEO for Good Reason within two years after a change in control (6) The ” Fees Audit fees (1) Audit-related fees Audit and audit-related fees Tax & Tax-Related compliance fees All other fees Total fees HEOP. Audit Committee Pre-Approval Policies and Procedures has been made available to shareholders and is posted from our website at 864-8000. The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy delivery requirements for annual reports, proxy statements, and Notices of Internet Availability of Proxy Materials with respect to two or more stockholders sharing the same address by delivering a single annual report, proxy statement, and Notice of Internet Availability of Proxy Materials addressed to those stockholders. This process, which is commonly referred to as (the "Board") has nominated each of the following persons for re-electionelection as a director. Under our Bylaws, directors are elected by the stockholders each year at the annual meeting of stockholders and shall hold office until the next annual meeting or until their successors are elected and qualified. Each nominee is currently a director of the Company and each has indicated that he or she is willing and able to continue to serve as a director. We have provided biographical and other information on each of the nominees beginning on page 67 of this Proxy Statement.John J. Carona M. Christian Mitchell Ayad A. Fargo Michael J. Morris Steven R. Gardner Zareh H. Sarrafian Joseph L. Garrett Cora M. Tellez Jeff C. Jones Simone F. LagomarsinoMichael J. MorrisMichael E. PfauZareh H. SarrafianCora M. Tellezten (10)nine (9) director nominees by the stockholders is the affirmative vote of a majority of the votes cast in favor of or against the election of such director nominee. If the election of directors were a contested election, which it is not, director nominees would be elected by a plurality of the votes cast at a meeting of stockholders by the holders of shares entitled to vote in the election. There is no cumulative voting for our directors. If you indicate "withhold"“abstain” for a particular nominee on your proxy card, your vote will not be considered in determining whether a nominee has received the affirmative vote of a majority of the votes cast in an uncontested election andor a plurality of the votes cast in a contested election. The election of directors is considered a "non-routine"“non-routine” item upon which brokerage firms may not vote in their discretion on behalf of their clients if such clients have not furnished voting instructions. Therefore, broker "non-votes"“non-votes” will not be considered in determining whether a nominee has received the affirmative vote of a majority of the shares in an uncontested election andor a plurality of the shares in a contested election.the accompanying yourproxy may be voted for the election of such other person as shall be designated by the Nominating and Corporate Governance Committee (the "Nominating Committee"“Governance Committee”) of our Board of Directors. Proxies granted may not be voted for a greater number of nominees than the ten (10)nine (9) named above. Unless instructions to the contrary are specified in a proxy properly voted and returned through available channels, the proxies will be votedFOR each of the nominees listed above."“FOR"” EACH OF THE DIRECTOR NOMINEES.61,63, has servedwas appointed to serve as a member of the Board andof Directors of the Bank's board of directors (the "Bank Board") since 2013, when he was appointed to the BoardCompany and the Bank Boardin March 2013, in connection with the Company'sCompany’s acquisition of First Associations Bank ("FAB"(“FAB”). Mr. Carona served as a director of FAB since its inception in 2007. Mr. Carona is the President and Chief Executive Officer of AssociaAssociations, Inc. ("Associa"(“Associa”)., a Texas corporation that specializes in providing management and related services for homeowners associations (“HOAs”) located across the United States. Mr. Carona was a six term Senator in the State of Texas from 1990 to 2014, where he represented District 16 in Dallas County. Previously, Mr. Carona was elected to three terms in the Texas House of Representatives. Mr. Carona served as Chairman of the Senate Business and Commerce Committee, Joint Chairman of the Legislative Oversight Board on Windstorm Insurance and as Co-Chairman of the Joint Interim Committee to Study Seacoast Territory Insurance. He also served as a member of the Senate Select Committee on Redistricting and the Senate Criminal Justice, Education and Jurisprudence committees. Previously, he served as Chairman of the Senate Transportation and Homeland Security Committee. SenatorMr. Carona received a Bachelor of Business Administrationhis B.B.A. degree in insurance and real estate from the University of Texas at Austin in 1978.56,58, was appointed to serve as a member of the Board of Directors of the Company and the Bank Board onin January 31, 2016, in connection with the Company'sCompany’s acquisition of Security California Bancorp ("SCAF"(“SCAF”) and its banking subsidiary Security Bank of California ("SBC"(“SBC”). Mr. Fargo has served as the President of Biscomerica Corporation, a food manufacturing company based in Rialto, California, since 1984. Prior to joining the Board and the Bank Board, Mr. Fargo served as a director of SCAF and SCB since 2005. Mr. Fargo received his B.S. from Walla Walla University.56,58, has been President, Chief Executive OfficerCEO and a director of the Company since 2000. Mr. Gardner has been the CEO and a director of the Bank since 2000, and also served as the Bank’s President from 2000 until 2016. Mr. Gardner became Chairman of the Board of the Company and the Bank in May 2016. Prior to joining the Company he was an executive of Hawthorne Financial since 1997 responsible for credit administration and portfolio management. HeMr. Gardner has more than 30 years of experience as a commercial banking executive. He has extensive knowledge of all facets of financial institution management, including small and middle marketmanagement. Having completed 10 acquisitions of whole banks, specialty finance lines of business banking, investment securities management, loan portfolio and credit risk management, enterprise risk management and retail banking. As the architect of both whole bank and FDIC assisted acquisitions as well as the acquisition of a nationwide specialty finance firm,failed banks, Mr. Gardner has significant experience in successfully acquiringall areas of mergers and integrating financialacquisitions as well as capital market transactions.currently serves onhas served in various high-level roles in trade associations and organizations that serve the Boardsbanking industry, including as a member of the Board of Directors of the Federal Reserve Bank of San Francisco andsince January 2013. Mr. Gardner formerly served on the Board of Directors of the Federal Home Loan Bank of San Francisco, and he served aswas the former Chairman of the Finance Committee of the Federal Home Loan Bank of San Francisco. Mr. Gardner previously served as the Vice Chairman of the Federal Reserve Bank of San Francisco'sFrancisco’s Community Depository Institutions Advisory Council, as a Directordirector and a member of the Executive Committee of the Independent Community Bankers of America ("ICBA"(“ICBA”), and as a director of ICBA Holding Company and ICBA Securities, a registered broker-dealer. Additionally, Mr. Gardner served as the former President and Chairman of the California Independent Bankers. Mr. Gardner holds a B.A. from California State University, Fullerton.68,70, has served as a member of the Board of Directors of the Company and the Bank Board since 2012. Mr. Garrett was the President, Chief Executive Officer, a member and chairman of the Board of Directors for both American Liberty Bank and Sequoia National Bank. He also served as a member of the Board of Directors for Hamilton Savings Bank. Since 2003, Mr. Garrett has been a principal at Garrett, McAuley & Co., which provides mortgage banking advisory services to commercial banks, thrifts, and mortgage banking companies. He served on the California State Controller'sController’s Advisory Commission on Public Employee Retirement Systems and currently serves on the National Advisory Council for the Institute of Governmental Studies at the University of California (Berkeley).62,64, has served as a member of the Board of Directors of the Company and the Bank Board since 2006, and wasserved as Chairman of the Board of the Company and the Bank from August 2012 to May 2016. He currently serves as the Board’s lead independent director. Mr. Jones is the currentformer Managing Partner and current Executive Committee member of, and partner in, the regional accounting firm Frazer, LLP, with which he has been withaffiliated since 1977. Mr. Jones has over 30 years of experience in servicing small and medium sized business clients primarily within the real estate, construction, and agricultural industries. Mr. Jones is a past president of Inland Exchange, Inc., an accommodator corporation, and has served on the Board of Directors of Moore Stephens North America, Inc. Mr. Jones holds a B.S. degree in Business Administration from Lewis and Clark College in Portland, Oregon, and a Masters of Business Taxation from Golden Gate University. Mr. Jones is a CPA in California, is licensed as a life insurance agent and holds a Series 7 securities license.Simone F. Lagomarsino, 55,M. Christian Mitchell, 63, was appointed as a directormember of the Board of Directors of the Company and the Bank effectivein July 2018, in connection with the Company’s acquisition of Grandpoint Capital, Inc. and its subsidiary Grandpoint Bank (collectively, “Grandpoint”). Mr. Mitchell is a retired Deloitte senior partner, where he served as the national managing partner for the firm’s Mortgage Banking/Finance Companies practice and was a founding member of the board of directors of Deloitte Consulting USA, among other leadership roles. Prior to the Grandpoint acquisition, Mr. Mitchell served as lead independent director and chaired the Audit and Risk Committees for Grandpoint. He currently serves as lead independent director of Western Asset Mortgage Capital Corporation (NYSE: WMC), a public mortgage REIT, where he chairs the Audit Committee and serves on the Compensation, Nominating and Corporate Governance and Risk Committees. In addition, Mr. Mitchell serves as a director of several private companies, including Marshall & Stevens, Inc., a Los Angeles-based national financial valuation and advisory firm, where he serves as Vice Chairman; Parsons Corporation, a digitally enabled solutions provider focused on the defense, security and infrastructure markets; and Stearns Holdings, LLC, a national independent mortgage company. Mr. Mitchell is Chairman Emeritus of the National Association of Corporate Directors, Pacific Southwest Chapter, and in 2017 was elected to the organization’s national board of directors. Mr. Mitchell taught as an adjunct Accounting Professor at the University of Redlands from 2006 through May 2010 and a guest lecturer from 2010 to 2017. In 2011 and 2012, Directorship magazine named Mr. Mitchell to the “100 Most Influential People in Corporate Governance” list. Mr. Mitchell earned his B.S. degree from the University of Alabama. 1, 2017, in connection with the Company'sCompany’s acquisition by merger of Heritage Oaks Bancorp, (NASDAQ: HEOP) ("HEOP"Inc. (“HEOP”) and its wholly-owned subsidiary, Heritage Oaks Bank, which had approximately $2 billion of consolidated total assets on the date of acquisition. Ms. Lagomarsino was appointed as the President and Chief Executive Officer of the California Bankers Association in April 2017. In addition, Ms. Lagomarsino has served on the board of directors of the Federal Home Loan Bank of San Francisco since 2013, where she has served as Chair of the Audit Committee since 2015 and served as Vice Chair of the Audit Committee in 2014. Prior to joining the Company's and the Bank's boards of directors, Ms. Lagomarsino was a director, President and Chief Executive Officer of HEOP, and Chief Executive Officer of Heritage Oaks Bank, beginning on September 10, 2011. She was appointed President of Heritage Oaks Bank in January 2012 and served in that position until January 2015. Ms. Lagomarsino, a financial services professional, has over 30 years of experience in executive leadership positions in the financial services industry, including serving in such capacities as President and Chief Executive Officer of Hawthorne Financial Corporation (NASDAQ: HTHR) and Chief Financial Officer of Ventura County National Bank (NASDAQ: VCNB). Ms. Lagomarsino previously served on the boards of directors of the Alzheimer's Association's California Central Coast Chapter, Sierra Vista Regional Medical Center, and the Foundation for the Performing Arts Center of San Luis Obispo, and is the majority owner of Vino Al Lago LLC. Ms. Lagomarsino received her B.A. from Claremont McKenna College and her M.B.A. from Claremont Graduate School. Ms. Lagomarsino's extensive background in banking, including her experience as a Chief Executive Officer and Chief Financial Officer of publicly-traded financial institutions, enables her to provide valuable perspective to the Board.Michael J. Morris, 71, was appointed as a director of the Company and of the Bank effective April 1, 2017, in connection with the Company's acquisition of HEOP and its subsidiary Heritage Oaks Bank. Mr. Morris is an attorney and serves as Chairman of the Board of the law firm of Andre, Morris & Buttery. He has been a member of the Board of Directors of NioCorp, a publicly held company traded on the Toronto Stock Exchange, since 2014. He has served as a member and chairman of various non-profit boards of directors. He has practiced law in California for over 40 years, during which he has represented a broad array of corporate and individual clients. Prior to joining the Board and the Bank Board, Mr. Morris was a director of HEOP and of Heritage Oaks Bank beginning in January of 2001, and served as the Chairman of HEOP and Heritage Oaks Bank beginning onin May 24,of 2007. The inclusion of Mr. Morris as a director provides the Board with a unique understanding of a broad range of legal and regulatory matters in its oversight of the Company. Furthermore, his extensive knowledge of local markets and the communities served by the Company gives him unique insights into the Company's lending challenges and opportunities. Mr. Morris received his B.A. from Georgetown University and his J.D. from the University of San Francisco School of Law.Table of ContentsMichael E. Pfau, 63,Zareh H. Sarrafian, 55, was appointed to serve as a directormember of the Board of Directors of the Company and the Bank effective April 1, 2017, in connection with the Company's acquisition of HEOP and its subsidiary Heritage Oaks Bank. Mr. Pfau was a founding director for Business First National Bank in 2001. With the acquisition of Business First National Bank by HEOP, he was appointed to the Board of HEOP and Heritage Oaks Bank in October 2007. Mr. Pfau is the founding partner of the law firm Reicker, Pfau, Pyle & McRoy LLP, in Santa Barbara. His law practice focuses upon the representation of emerging-growth technology companies, institutional real estate investors, and high net worth individuals. His transactional experience includes the representation of parties involved with public and private securities offerings, initial public offerings, and asset-purchase, merger, and stock-for-stock merger and acquisition transactions, as well as sophisticated real estate purchase and lease transactions. He has served as a member and chairman of various non-profit boards. Mr. Pfau's expertise in complex business transactions and knowledge of the Santa Barbara market, as well as his extensive legal experience, enhance his ability to contribute to the Company as a director. Mr. Pfau received his B.A. from the University of Cincinnati, his J.D. from the Boston College Law School and his LL.M. from Georgetown University Law Center.Zareh H. Sarrafian, 53, was appointed to the Board and Bank Board on January 31, 2016, in connection with the Company'sCompany’s acquisition of SCAF and its subsidiary SCB. Mr. Sarrafian has served as the Chief Executive OfficerCEO of Riverside County Regional Medical Center in Riverside, California since 2014. Prior to that, Mr. Sarrafian served as Chief Administrative Officer at Loma Linda Medical Center in Loma Linda, California since 1998. Prior to joining the Company'sBoards of Directors of the Company and the Bank's boards of directors,Bank, Mr. Sarrafian served as a director of SCAF and SBC since 2005. Mr. Sarrafian currently serves on the Board of Directors of Switch, Inc., a technology infrastructure corporation headquartered in Las Vegas, Nevada, where he serves on the Audit and Governance Committees. Mr. Sarrafian received his B.S. from California State Polytechnic University, Pomona, and his M.B.A. from California State University, San Bernardino.67,69, has served as a member of the Board of Directors of the Company and the Bank Board since October 2015. Ms. Tellez has served as the Chief Executive OfficerCEO and President of both Sterling Health Services Administration, Inc. and Sterling Self Insurance Administration since founding the companies in 2003 and 2010, respectively. Ms. Tellez previously served as the President of the health plans division of Health Net, Inc., an insurance provider that operated in seven states. She also has served as President of Prudential`sPrudential’s western healthcare operations, Chief Executive OfficerCEO of Blue Shield of California, Bay Region, and Regional Manager for Kaiser Permanente of Hawaii. Ms. Tellez serves on the boardsboard of directors of HMS Holdings, Inc., (NASDAQ:HMSY) ("HMS"(“HMS”), and CorMedix (NYSE:CRMD).previously was a director of CorMedix. For HMS, Ms. Tellez chairs the Nominating and Governance Committee and serves on the Audit and Compensation Committees. For CorMedix, Ms. Tellez chairs the board of directors and serves on the Audit and Nominating and Governance Committees. She also serves on several nonprofit organizations such as the Institute for Medical Quality and UC San Diego'sDiego’s Center for Integrative Medicine. Ms. Tellez received her B.A. from Mills College and her M.S. in public administration from California State University, Hayward.Executive Officers Who Are Not Serving As Directorsofficer'sofficer’s business experience.50,52, President and Chief Banking Officer of the Bank, was hired in August 2003 as the Bank's Senior Vice President and Chief Credit Officer. In September 2004, Mr. Wilcox was promoted to Executive Vice President and was responsible for overseeing loan and deposit production. In the fourth quarter of 2005, Mr. Wilcox was promoted to Chief Banking Officer and assumed responsibility of the branch network. In March 2014, Mr. Wilcox was promoted to Chief Operating Officer of the Bank. InBank, has served the Bank in key leadership positions for over 15 years. He commenced service as the Bank’s President in May 2016 and in November 2018, after a review of the day-to-day functions of the Bank’s senior executive officers, it was determined that Mr. Wilcox’s title also should include Chief Operating Officer without any change in responsibility, having previously had that title from March 2014 to April 2015,2015. Mr. Wilcox was initially hired as the Bank’s Chief Credit Officer in August 2003, and was promoted to Senior Executive Vice President andserve as the Bank’s Chief Banking Officer and served in that role until his appointment as President and Chief BankingTablethe fourth quarter of ContentsOfficer in May 2016.2005. Prior to joining the Bank, Mr. Wilcox served as Loan Production Manager at Hawthorne Savings Bank for two years and as the Secondary Marketing Manager at First Fidelity Investment & Loan for five years. Mr. Wilcox has an additional nine years of experience in real estate banking, including positions as Asset Manager, REO Manager and Real Estate Analyst at various financial institutions. Mr. Wilcox obtained his B.A. degree in Finance from New Mexico State University.58,60, Senior Executive Vice President/President and Chief Financial Officer (“CFO”) of the Company and the Bank, was hired in May 2016. Mr. Nicolas serves as Chairman of the Bank'sBank’s Asset Liability Committee and the Bank’s Financial Disclosure Committee. Prior to joining the Company and Bank, Mr. Nicolas served as Executive Vice President and Chief Financial Officer at each of: Banc of California (2012-2016); Carrington Holding Company, LLC (2009-2012); Residential Credit Holdings, LLC (2008-2009); Fremont Investment and Loan (2005-2008); and Aames Investment/Financial Corp. (2001-2005). Earlier in his career, Mr. Nicolas served in various capacities with KeyCorp, a $60-billion financial institution, including Executive Vice President Group Finance of KeyCorp (1998-2001), Executive Vice President, Treasurer and Chief Financial Officer of KeyBank USA (1994-1998), and Vice President of Corporate Treasury (1993-1994). Before joining KeyCorp, he spent eight years at HSBC-Marine Midland Banks in a variety of financial and accounting roles. Mr. Nicolas obtained his B.S. degree in Finance and his Masters in Business AdministrationM.B.A. from Canisius College.48,50, Senior Executive Vice President/President and Chief CreditRisk Officer of the Bank, was hired in April 2006. Mr. Karr was appointed Chief Risk Officer of the Bank in March 2018, and in that capacity oversees the Bank's credit functions and has responsibility for all lending and portfolio operations.Bank’s enterprise risk management function. He is the Chairman of the Bank'sBank’s Enterprise Risk Management Committee. Mr. Karr previously served as the Chief Credit Committeeofficer of the Bank and its Creditwas responsible for overseeing the Bank’s credit functions, including all lending and Portfolio Review Committee.portfolio operations. Prior to joining the Bank, Mr. Karr worked for Fremont Investment & Loan for 11 years as Vice President in charge of their Commercial Real Estate Asset Management department. Mr. Karr obtained his B.A. degree, in Economics and Government, cum laude, from Claremont McKenna College and his Masters in Business AdministrationM.B.A. from the University of California, Irvine.45,47, Senior Executive Vice President/President and Chief OperatingInnovation Officer of the Bank, was hired in November 2008 as the Bank's Senior Vice President and Chief Information Officer. Mr. Rice has overseen the technology and security functions since 2008 and led the smooth systems conversions and integrations of the last seven acquisitions.2008. Mr. Rice was appointed Executive Vice President and Chief Operating Officer of the Bank in April 2015 and assumed responsibility for operations of the Bank. In November 2018, after a review of the day-to-day functions of the Bank’s senior executive officers, including Mr. Rice’s role in overseeing the development of innovative solutions and technologies focusing on specialized deposit markets and commercial treasury services, it was determined that Mr. Rice’s title should be changed to Chief Innovation Officer of the Bank, without any change in Mr. Rice’s role or scope of responsibilities. Mr. Rice has overseen the Bank’s technology systems since 2008 and has led the systems conversions and integrations of the Company’s last 10 acquisitions. Prior to joining the Bank, Mr. Rice was a founding partner at Compushare, where he oversaw the company'scompany’s expansion and several system conversions of his banking clients. Mr. Rice obtained his B.S. degree in Computer Information Systems from DeVry University.GuidelinesPolicy that our Board has approved to achieve the following goals:•••GuidelinesPolicy is available within our Corporate Governance Policy which is onfrom our website atwww.ppbi.comunder the Investor RelationsInvestors section. Our stockholders may also obtain a written copy of the guidelines at no cost by writing to us at 17901 Von Karman Avenue, Suite 1200, Irvine, California 92614, Attention: Investor Relations Department, or by calling (949) 864-8000.NominatingGovernance Committee of our Board of Directors administers our Corporate Governance Guidelines,Policy, reviews performance under the guidelines and the content of the guidelines annually and, when appropriate, recommends that our Board approve updates and revisions to our Board of Directors.NominatingGovernance Committee is responsible for reviewing with the Board of Directors annually the appropriate skills and characteristics required of the Board members, and for selecting, evaluating and recommending nominees for election by our stockholders. The NominatingGovernance Committee has authority to retain a third-party search firm to identify or evaluate, or assist in identifying and evaluating, potential nominees if it so desires, although it has not done so to date.NominatingGovernance Committee considers such other relevant factors, as it deems appropriate, including the current composition of the Board, the need for Audit Committee expertise, and the director qualification guidelines set forth in the Company'sCompany’s Corporate Governance Policy.Under the Company'sCompany’s Corporate Governance Policy, the factors considered by the NominatingGovernance Committee and the Board in its review of potential nominees and directors include: integrity and independence; substantial accomplishments, and prior or current association with institutions noted for their excellence; demonstrated leadership ability, with broad experience, diverse perspectives, and the ability to exercise sound business judgment; the background and experience of candidates, particularly in areas important to the operation of the Company such as business, education,commercial banking, finance, bank regulation, enterprise risk management, government, law or banking;and education; the ability to make a significant and immediate contribution to the Board'sBoard’s discussions and decision-making; special skills, expertise or background that add to and complement the range of skills, including investment banking and mergers and acquisitions; expertise and background of the existing directors; career success that demonstrates the ability to make the kind of important and sensitive judgments that the Board is called upon to make; and the availability and energy necessary to perform his or her duties as a director. In addition, the NominatingGovernance Committee and the Board believesbelieve the composition of the Board should reflect sensitivity to the need for diversity as to gender, ethnic background and experience.experience, and are particularly mindful of this need for diversity as candidates are considered to fill current Board vacancies. Application of these factors involves the exercise of judgment by the Board and cannot be measured in any mathematical or routine way.NominatingGovernance Committee determines whether to interview the prospective nominee, and if warranted, one or more members of the NominatingGovernance Committee, in concert with the Company's Chief Executive Officer ("CEO"),Company’s CEO, interviews prospective nominees. After completing its evaluation, the NominatingGovernance Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees after considering the recommendation and report of the NominatingGovernance Committee.NominatingGovernance Committee in concluding that the nominee or the director should serve or continue to serve as a director of the Company. The table below supplements the biographical information provided above.factorsattributes and qualifications reviewed by the NominatingGovernance Committee in evaluating a board candidate.CaronaFargoGardnerGarrettJonesLagomarsinoMorrisPfauSarrafianTellez Carona Fargo Gardner Garrett Jones Mitchell Morris Sarrafian Tellez Professional standing in chosen field X X X X X X X X X Expertise in banking, financial services or related industry X X X X X X X X Audit Committee Financial Expert qualifications X X X X X X Enterprise Risk Management X X X X X X Civic and community involvement X X X X X X X X X Public company oversight X X X X X X Leadership and team building skills X X X X X X X X X Specific skills/knowledge: Professional standing in chosen fieldX- finance and investment banking X X X X X X X X X Expertise in financial services or related industry X X XXXXXXXAudit Committee Financial Expert (actual or potential) XXXX X X Civic and community involvement X X X X - government and public affairs X X - governance X X X X X X X X X Other public company experience- human resources X XXXXXXLeadership and team building skillsXXXXXXXXXXSpecific skills/knowledge: – financeXXXXXXXXXX – marketingXXX – public affairsX X – human resourcesXXX – governanceX X XXXXXXXXNominatingGovernance Committee by submitting the individual'sindividual’s name and qualifications to our Corporate Secretary at 17901 Von Karman Avenue, Suite 1200, Irvine, CA 92614. Our NominatingGovernance Committee will consider all director candidates properly submitted by our stockholders in accordance with our Bylaws and Corporate Governance Guidelines. The BoardsDirectors of the Companyour Board and the Bank currently have ten (10) members serving, all of whom areBank’s Board is elected annually and will continue to serve until their successors are elected and qualified.qualified, or until their early resignation. Our Corporate Governance Guidelines requirePolicy requires that our Board of Directors consist predominantly of directors who are not currently, and have not been, employed by us during the most recent three years, employed by us (i.e. non-management directors). Currently, the Company'sCompany’s Chairman, President and CEO, Mr. Gardner, is the only director who is also a member of management.Guidelines requirePolicy requires that a majority of theour Board of Directors consist of "independent directors"“independent directors” as defined under the NASDAQ Stock Market (��NASDAQ”) rules. No director will be "independent"“independent” unless the Board of Directors affirmatively determines that the director meets the categorical standards set forth in the NASDAQ rules and otherwise has no relationship with the Company that, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and has no material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company. In addition, the Board of Directors considers the director independence guidelines established by institutional shareholder advisory services. The Board of Directors balances those guidelines with the independence standards established by the NASDAQ Stock Market rules and other important qualitative factors identified by the Board of Directors when evaluating whether an individual who otherwise satisifiessatisfies the indpendenceindependence standards set forth in the NASDAQ Stock Market rules also should be considered sufficiently independent for service on the Audit, Compensation and NominatingGovernance Committees.NominatingGovernance Committee is responsible for the annual review, together with the Board of Directors, of the appropriate criteria and standards for determining director independence consistent with the NASDAQ Stock Market rules. The Board of Directors has determined that Ayad A. Fargo, Joseph L. Garrett, Jeff C. Jones, Simone Lagomarsino,M. Christian Mitchell, Michael Morris, Michael Pfau, Zareh H.Stock Market Rulesrules and have no material relationships with the Company.director'sdirector’s basic duties of care and loyalty, the Board of Directors has separate and specific obligations enumerated in our Corporate Governance Guidelines.Policy. Among other things, these obligations require directors to effectively monitor management'smanagement’s capabilities, compensation, leadership and performance, without undermining management'smanagement’s ability to successfully operate the business. In addition, ourOur Board and its committees have the authority to retain and establish the fees of outside legal, accounting or other advisors, as necessary to carry out their responsibilities.The sizeOur Bylaws provide our Board with discretion to fix the number of directors by resolution. Currently, the Board shall be designated bysize is fixed at eleven (11) members, with nine (9) members currently serving and two vacancies resulting from recent director resignations. We currently are considering potential candidates to fill these vacancies, but are not prepared to nominate any candidates in connection with the Board, but shall be seven (7) in the absence of such designation.Annual Meeting. Vacancies on the Board may be filled by a majority of the remaining directors. A director elected to fill a vacancy, or a new directorship created by an increase in the size of the Board, serves for a term expiring at the next annual meeting of stockholders.Directors has no fixed policy with respectits stockholders. Each year, the Board evaluates its leadership structure to the separation ofensure that it remains appropriate. Currently, the offices of Chairman of the Board of Directors and CEO. Our Board retains the discretion to make this determination on a case-by-case basis from time to time as it deems to be in the best interests of the Company and our stockholders at any given time. The offices of Chairman of the Board of Directors and CEO currently are jointly held. Theheld and the Board has designated a lead independent director to ensure independent director oversight of the Company andCompany.and procedures for the workBoard;Board.Company'sCompany’s risk management processes. The Board delegates many of these functions to the Audit Committee.and Enterprise Risk Committees. Under its charter, the Audit Committee is responsible for monitoring business risk practices and legal and ethical programs. In this way, the Audit Committee helps the Board fulfill its risk oversight responsibilities relating to the Company'sCompany’s financial statements, financial reporting process and regulatory requirements. The Audit Committee also oversees our corporate compliance programs, as well as the internal audit function.Committee'sand Enterprise Risk Committees’ work in overseeing risk management, our full Board regularly engages in discussions of the most significant risks that the Company is facing and how these risks are being managed, and the board receives reports on risk management from senior officers of the Company and from the chair of the Audit Committee. The Board receives periodic assessments from the Company's ongoing enterprise risk management process that are designed to identify potential events that may affect the achievement of the Company's objectives. In addition,managed. Further, our Board and its standing committees periodically request supplemental information or reports as they deem appropriate.Withwith DirectorsCompany'sCompany’s Corporate Secretary will sort the Board correspondence to classify it based on the following categories into which it falls: stockholder correspondence, commercial correspondence, regulatory correspondence or customer correspondence. Each classification ofAll stockholder correspondence will then be handled in accordance with a policy unanimously approved byforwarded to the Board. During 2016, ourten fullseven regularly-scheduled Board meetings in 2017.2019, and any special meetings that may be necessary or appropriate. Directors, on average, attended approximately 98%94% of the Board and applicable Board committee meetings during 2016.2018. All of our directors are encouraged to attend each meeting in person. Our management provides all directors with an agenda and appropriate written materials sufficiently in advance of the meetings to permit meaningful review. Any director may submit topics or request changes to the preliminary agenda as he or she deems appropriate in order to ensure that the interests and needs of non-management directors are appropriately addressed. To ensure active and effective participation, all of our directors are expected to arrive at each Board and committee meeting having reviewed and analyzed the materials for the meeting.Company'sCompany’s policy that the independent directors of the Company meet in executive sessions without management at least twice on an annual basis in conjunction with regularly scheduled board meetings. Executive sessions at which the independent directors meet with the CEO also may be scheduled. During 2016,2018, the independent directors met seven8 times in executive sessionsessions without the presence of management.20162018 Annual Meeting of Stockholders.Chief Financial Officer ("CFO"),CFO, other senior management, and to all of our officers and employees. Our Code of Business Conduct and Ethics provides fundamental ethical principles to which these individuals are expected to adhere. Our Code of Business Conduct and Ethics operates as a tool to help our directors, officers, and employees understand and adhere to the high ethical standards required for employment by, or association with, the Company and the Bank. Our Code of Business Conduct and Ethics is available onfrom our website atwww.ppbi.com under the Investor RelationsInvestors section. Our stockholders may also obtain written copies at no cost by writing to us at 17901 Von Karman Avenue, Suite 1200, Irvine, California 92614, Attention: Investor Relations Department, or by calling (949) 864-8000. Any future changes or amendments to our Code of Business Conduct andNominating & Corporate Governance Committee, and ExecutiveEnterprise Risk Management Committee as of December 31, 2018, as well as the number of meetings each committee held during the year ended December 31, 2016.2018.Committees of the Board of Directors (2016)Audit CompensationBoard CommitteeDirector Nominating &CorporateGovernanceAudit ExecutiveCommittee Kenneth A. BoudreauCompensation Governance John J. Carona Ayad A. Fargo Kenneth A. Boudreau Steve Gardner *Joseph GarrettX Joseph Garrett *X Jeff C. Jones *Steven R. Gardner X* Jeff C. Jones John D. Goddard X* Zareh SarrafianX Jeff C. JonesMichael L. McKennon *X Jeff C. JonesM. Christian Mitchell Michael L. McKennonMichael L. McKennonCora TellezCora TellezX Zareh Sarrafian10 meetings held in2016 4 meetings held in20161 meeting held in2016No meetings held in2016*Chairperson Set forth below is the membership of our Audit Committee, Compensation Committee, Nominating & Corporate Governance Committee, and Executive Committee effective April 13, 2017.Committees of the Board of Directors (Effective April 13, 2017)AuditCompensationNominating &CorporateGovernanceExecutiveCommittee Joseph GarrettAyad FargoJeff C. Jones *Steve Gardner *Jeff C. JonesJoseph Garrett *Simone LagomarsinoJoseph GarrettSimone Lagomarsino *Jeff C. JonesMichael PfauJeff C. JonesXMichael J. Morris Michael PfauX X* Zareh H. Sarrafian Zareh SarrafianCora TellezX X* X X X 9 meetings in 2018 7 meetings in 2018 6 meetings in 2018 2 meetings in 2018 * Chairperson

(2) On March 25, 2019, pursuant to the Company’s regular committee rotations, Ms. Tellez was rotated off of the Audit Committee, and Mr. Garrett became a member of the Governance Committee.*ChairpersonCompany'sCompany’s Board committees and the composition of each committee is set forth below.Company'sCompany’s independent auditors, reporting to the Board on the general financial condition of the Company and the results of the annual audit, and ensuring that the Company'sCompany’s activities are being conducted in accordance with applicable laws and regulations. The internal auditor of the Bank participates in the Audit Committee meetings. A copy of the Audit Committee charter can be found onfrom the Company'sCompany’s website atwww.ppbi.com under the Investor RelationsInvestors section.The Board has determined that eachEach of the Audit Committee membermembers is financially sophisticated and is "independent"considered “independent” under the NASDAQ listing standards andSEC.U.S. Securities and Exchange Commission (the “SEC”). The Board of Directors has determined that each of Messrs. Jones, Mitchell, Morris, Sarrafian and Ms. LagomarsinoTellez satisfies the requirements established by the SEC for qualification as an "audit“audit committee financial expert."Bank'sBank’s compensation policies, benefits and practices, (ii) approves all stock option, restricted stock and restricted stock unit ("RSUs") grants, (iii) has oversight responsibility for management planning and succession, and (iv) determines the annual salary, the annual bonus, stock options, and restricted stock grants of our CEO, CFO and other named executive officers, and (iv) approves the CEO, President, Chief Banking Officer ("CBO"), CFO, Chief Credit Officer ("CCO"), and Chief Operating Officer ("COO").compensation structure for other members of our senior management team. Each of the Compensation Committee members is considered "independent"“independent” under the NASDAQ listing standards and rules of the SEC. A copy of the Compensation Committee charter can be found onfrom the Company'sCompany’s website atwww.ppbi.com under the Investor RelationsInvestors section.2016,2018, the Compensation Committee engaged Pearl Meyer & Partners ("Pearl Meyer"Willis Towers Watson (“WTW”) to assist the Compensation Committee with its responsibilities related to our executive and Board compensation programs. Pearl MeyerWTW does not provide other services to the Company. Additionally, based on standards promulgated by the SEC and the NASDAQ to assess compensation advisor independence and the analysis conducted by Pearl MeyerWTW in its independence review, the Compensation Committee concluded that Pearl MeyerWTW is independent and a conflict-free advisor to the Company. Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee has oversight responsibility for nominating candidates as directors and to determine satisfaction of independence requirements.requirements, for overseeing our Board governance structure and policies, and for CEO succession planning. The Nominating and Corporate Governance Committee has adopted a written charter. A copy of the charter and the Company'sCompany’s Corporate Governance Guidelines can both be found onfrom the Company'sCompany’s website atwww.ppbi.com under the Investor RelationsInvestors section.NominatingGovernance Committee include:••••• and•Board'sBoard’s performance and the performance of the Board committees. Executive Committee.Enterprise Risk Committee. The ExecutiveEnterprise Risk Committee may exercise all authority(the “ER Committee”) oversees the design and implementation of the Board inCompany’s enterprise risk program. The primary purposes of the intervals between Board meetings, except for certain matters.ER Committee are to monitor and review the Company’s enterprise risk management framework and risk appetite, monitor and review the adequacy of enterprise risk management functions, and report conclusions and recommendations to the Board. The Executive Committee'sER Committee has adopted a written charter, a copy of which can both be found from the Company’s website at www.ppbi.com under the Investors section.include: (i) acting on behalfof our ER Committee include but are not limited to:Board upon any routine operational matters, or such other matters, which, inenterprise risk management activities across various functions, including loan review, compliance, information security, vendor and model risk management and business continuity programs;opinion ofCompany’s risk profile for alignment with the Chairman of the Board, should not be postponed until the next regularly scheduled meeting of the Board, subject, in each case, to the limitationsCompany’s strategic objectives and risk appetite, including compliance with risk limits and thresholds set forth in the Executive Committee charterRisk Appetite Statement;Company's by-laws; and (ii) forming and delegating authority tosubcommittees when appropriate. A copycondition of the Executive Committee charter can be found onCompany may warrant, but no less than annually; andCompany's website at www.ppbi.com under the Investor Relations section.2016,2018, the Compensation Committee was comprised of Messrs. Fargo, Garrett, Goddard, and Jones, and Ms. Tellez, each of whom was an independent director. Following the Company's acquisition by merger of HEOP, effective April 13, 2017, Mr. Pfau replaced Mr. Goddard as a member of the Compensation Committee. None of these individuals is or has been an officer or employee of the Company during the last fiscal year or as of the date of this Proxy Statement, or is serving or has served as a member of the compensation committee of another entity that has an executive officer serving on the Compensation Committee. No executive officer of the Company served as a director of another entity that had an executive officer serving on the Compensation Committee. Finally, no executive officer of the Company served as a member of the compensation committee of another entity that had an executive officer serving as a director of the Company."Exchange Act"“Exchange Act”) and the related rules and regulations, our directors and executive officers and any beneficial owners of more than 10% of any registered class of our equity securities, are required to file reports of their ownership, and any changes in that ownership, with the SEC. Based solely on our review of copies of these reports and on written representations from such reporting persons, we believe that during 2016,2018, all such persons filed all ownership reports and reported all transactions on a timely basis, except that due to administrative oversights, two reports onone Form 43 was not timely filed for Mr. Robinson and Form 4s were not timely filed including onefor the following persons: Messrs. Garrett, Rice and Nicolas (1 report on Form 4 for Mr. Garret relating to an open market purchase on November 22, 2016 pursuant to a 10b5-1 plan, for which a Form 4 filing was made on November 25, 2016;each), and one report on Form 4 for Mr. Boudreau relating to an open market purchase on July 29, 2016, for which a Form 4 filing was made on August 5, 2016.Company'sCompany’s Audit, Nominating and Corporate Governance and Compensation Committees are currently composed entirely of "independent"“independent” directors, as defined by our Corporate Governance GuidelinesPolicy and applicable NASDAQ and SEC rules and regulations. Our Compensation, Audit Nominating and Corporate Governance and Executive Committees each have a written charter, which may be obtained onfrom our website at www.ppbi.com under the Investor RelationsInvestors section. Company stockholders may also obtain written copies of the charters at no cost by writing to us at 17901 Von Karman Avenue, Suite 1200, Irvine, California 92614, Attention: Investor Relations Department, or by calling (949) 864-8000.committee'scommittee’s activities to the full Board.Board at least quarterly.2016,2018, with respect to options and RSUsrestricted stock units outstanding and shares available for future awards under the Company'sCompany’s active equity incentive plans.Plan Category Number of Securities

to be Issued Upon

Exercise of

Outstanding

Options, Warrants

and Rights Weighted-Average

Exercise Price of

Outstanding

Options,

Warrants and

Rights (2) Number of Securities

Remaining Available for

Future Issuance under

Equity Compensation

Plans (excluding securities